Car import: Tips for buying a car without borders

If you want to save money when buying a car, it is sometimes worth taking a look across the border. In neighboring countries, new cars can be up to a third cheaper. However, you may not always be looking for a new model. All kinds of used cars are regularly imported from all over the world. It is just important to keep a few things in mind.

Importing within the EU can be worthwhile

BMW’s largest factory is not located in Bavaria, but in South Carolina. This is primarily where SUVs, which are in high demand all over the world, are built. As a result, the Munich-based company is the number one car exporter from the USA.

This example shows that the automotive industry thinks globally. However, this only applies to production, not to prices since these vary from country to country – especially in the EU economic area. For example, the same current Volkswagen Golf model costs less in Spain than in Germany. The reason behind the price fluctuation is the manufacturers’ net pricing, which is based on the purchasing power of the respective market. Therefore, vehicle imports offer a favorable alternative. Maybe this only applies to cars which are present in high volume. The more expensive the car, the smaller the difference.

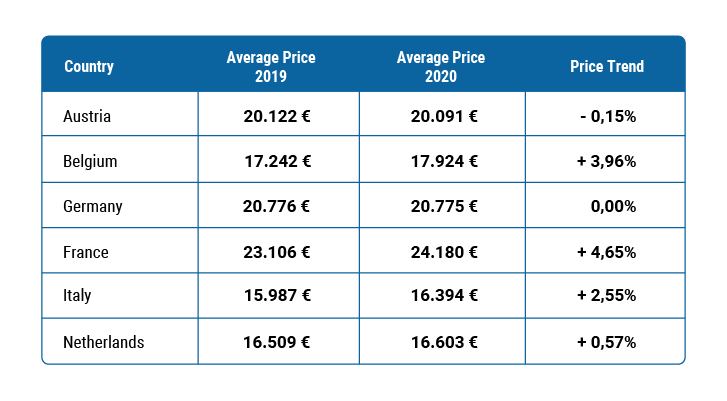

Average annual price for used cars per country

Local tax rules apply

Additionally, you pay duties and taxes where the car is registered. In other words, there are no registration fees in the car’s country of origin. For example, in Italy you pay fees for the registration in the Pubblico Registro Automobilistico, but if the car goes to Germany the standard rates there apply. In addition, the sales tax rates are reduced: VAT is 25% in Sweden, 21% in the Netherlands and Spain, and only 19% in Germany. This already reduces the price of the vehicle by at least 2%.

When the car arrives, you will have to declare the VAT within the designated time period. In Germany, it’s within ten days using Annex USt 1 B. If no VAT is due (e.g., Switzerland), be sure to include this in the purchase contract.

If you decide to import a vehicle within the EU, you can look online at local marketplaces or contact a car dealership that specializes in imported cars. It is important that the dealership is a car dealer and not a mediator. That is because mediators work as a “middle-man” and they do offer any warranty when it comes to the imported car.

When shopping abroad, you should always check the imprint on the website. There should be address, contact details, the name of the management and in most cases the tax number noted. If the information is not complete, caution is advised.

The insurer Allianz points out one more thing: If legal disputes arise, the legal system of the country where the purchase was made applies. Since the purchase contract is usually written in the language of that country, a translation may be required, including translation of the invoice.

Never buy a used car without a proper check

When buying a used car abroad, it is important to cross-check the sales information. Please keep in mind that this does not replace a test drive, though. If a test drive is not possible due to distance, an up-to-date technical inspection report should be requested from the seller.

Free, printable guide for safer used-car decisions.

According to the European Consumer Center (ECC), this is one of the required registration documents if the car is more than three years old. The registration office will provide information on whether the corresponding technical inspection report from the country of origin is also accepted. In addition, when registering the vehicle from another EU country, “the EC certificate of conformity or COC paper” must be presented. If this is not available, it can be requested from the manufacturer. If the form does not exist (e.g. in the case of re-imports from other EU countries or retrofitted vehicles), a full certificate from an inspection workshop, with a technical data sheet must be submitted. Lastly, there is the notification of Intra-Community acquisition (for new vehicles) which is available from the registration office, according to EVZ.

💡 Even though the term re-import is popularly used in everyday language, it is not always correct. This term only applies if it is resold in the country where it was produced. Example: An Audi from Ingolstadt that is imported into Germany from Poland would be considered a re-import. A Seat, on the other hand, is only an import because it is manufactured in Martorell near Barcelona.

Caution when buying from private sellers

If you’re a car enthusiast, you probably won’t find the car you’re looking for in a dealer lot, but likely offered by private individuals. When the seller is a private person, the used car history report should be checked via CARFAX. This is a wise investment (or this is money well spent). Unfortunately, criminal activity is present in private trade. They often demand a deposit of a few thousand in advance for transport or for other suspicious reasons. In these cases, we can only warn you: “Caution, it’s a trap!”. Especially if the seller insists on a quick bank transfer.

Imported cars from the USA are very popular

Fans of iconic U.S. vehicles should always get as accurate a picture of the car as possible before negotiating the sale. This is because repairs and restorations in the USA are sometimes carried out at a lower quality level than in Europe. Again, the CARFAX Vehicle History Report provides a good foundation for your research.

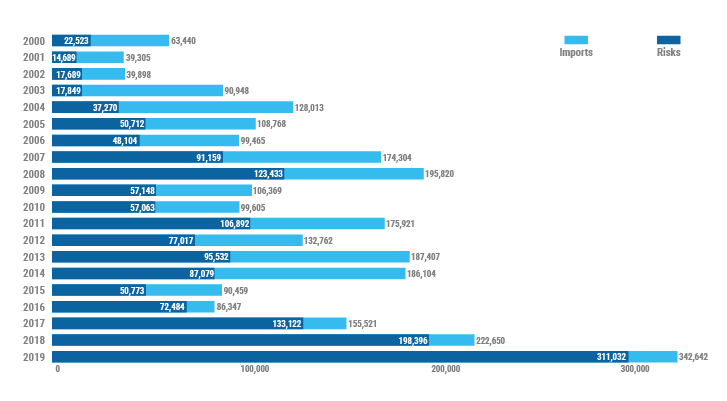

Since 2000, 1.7 million vehicles with previous damage have been exported from the USA to Europe. In the CARFAX Used Car Market Insights, you can see this development over the last five years. Behind these abstract numbers are 1.7 million individual stories and fates. People who saved up for their new car for a long time, only to receive an inferior and in some cases even unsafe car. According to a major online marketplace for used cars of seven European countries, the average price is roughly 23k euros. With that in mind, almost 40 billion euros were spent on vehicles with prior damage.

US imports to Europe - vehicles with risks

Another tip: Add up the additional costs before finalizing the purchase. Car import costs can add up to the sales price of a US import. These include import taxes, customs duties, transport insurance and costs, and registration. Not to mention possible technical conversion expenses - for U.S. vehicles these are the lights, which are checked for compliance with the inspection requirement, tires (if missing an EC or ECE mark) or the navigation system, which must be adapted to Europe. The same principle apply to the maximum values allowed in Europe regarding CO2 emissions and noise level. US vehicles are not only checked by customs, but must be presented to the main inspection in any case. This puts the purchase price into perspective once again. The ADAC has demonstrated this with an example of a purchase price of $15,000 (German customs converts the amount into euros at the respective daily exchange rate):

US purchase price of 15,000 US $ converted € 13,805

+ freight & insurance to German port approx. € 767 = € 14,572

+ 10 % customs duty € 1.457 = € 16.029

+ 19 % import sales tax € 3.046

= total amount € 19.075

The good news: No customs duty is required on classic cars from the States – unlike normal used cars. Another advantage is that a reduced import VAT rate of seven percent applies. To qualify, the car must be in original condition, have no fundamental modifications to the chassis, steering, brakes, or engine, and be 30 years old or no longer in production. Otherwise, 10 % duty applies EU-wide, according to the ADAC. According to the automobile club, the import duty is added to the so-called C.I.F. value (C.I.F. stands for Cost, Insurance and Freight). This is calculated from the purchase price, plus insurance, plus packaging and freight costs. The amount of import sales tax is determined based on the C.I.F. value and the import duty.

Now the car just has to be transported from the States to the EU. This takes up to four weeks if the car is at the port with complete papers three days before loading. Organizing this is possible for anyone, but it is at the expense of your nerves. With this in mind, a professional, which costs between 1,600 and 2,000 euros, may be worth the added cost.

Once the imported car is registered and allowed on domestic roads, nothing stands in the way of fun on the road, and the guarantee that your car will turn heads.

In addition to vehicle documents, contract and invoice, the Title Certificate is required for used vehicles. However, this does not provide information about the previous owners. For new vehicles you need the original Certificate of Origin including two notarized copies of the front and rear sides.